INVESTOR NOTE — REHAB-ONLY CAPITAL @ 12%

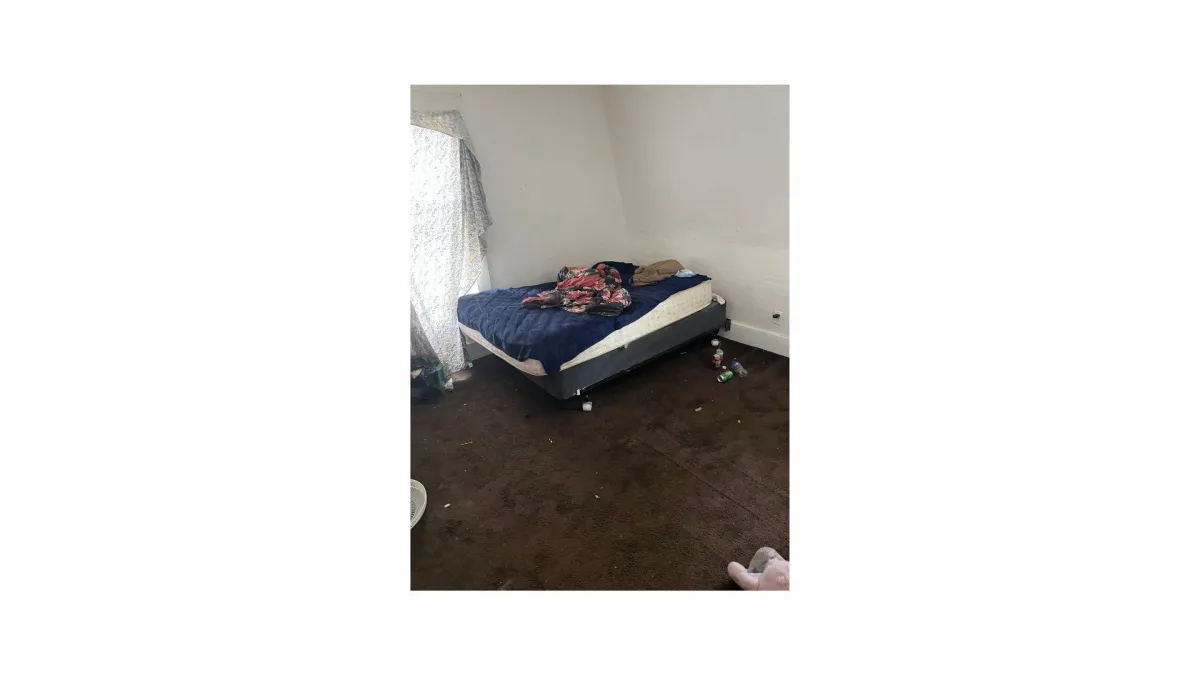

Property: 314 S Bingham St, Lansing, MI 48912

Beds/Baths: 3 / 2

ARV: $160,000

Date: 2025-09-02

DEAL STRUCTURE

- Purpose: Fund renovation only (acquisition and non-rehab costs covered by sponsor).

Capital Requested:

$53,000 (released in full at closing; NO DRAWS).

Interest: 12% simple annual interest, interest-only, NO profit split.

Payment Schedule: Monthly interest while funds are out; principal repaid in full at sale/maturity.

• Monthly interest on $53,000 @ 12% = $530.00

- Term: 2 months; hard maturity at 5 months (or earlier upon sale).

- Prepayment: Allowed anytime; no prepayment penalty;

interest prorated to payoff date.

USE OF FUNDS (TOTAL $53,000)

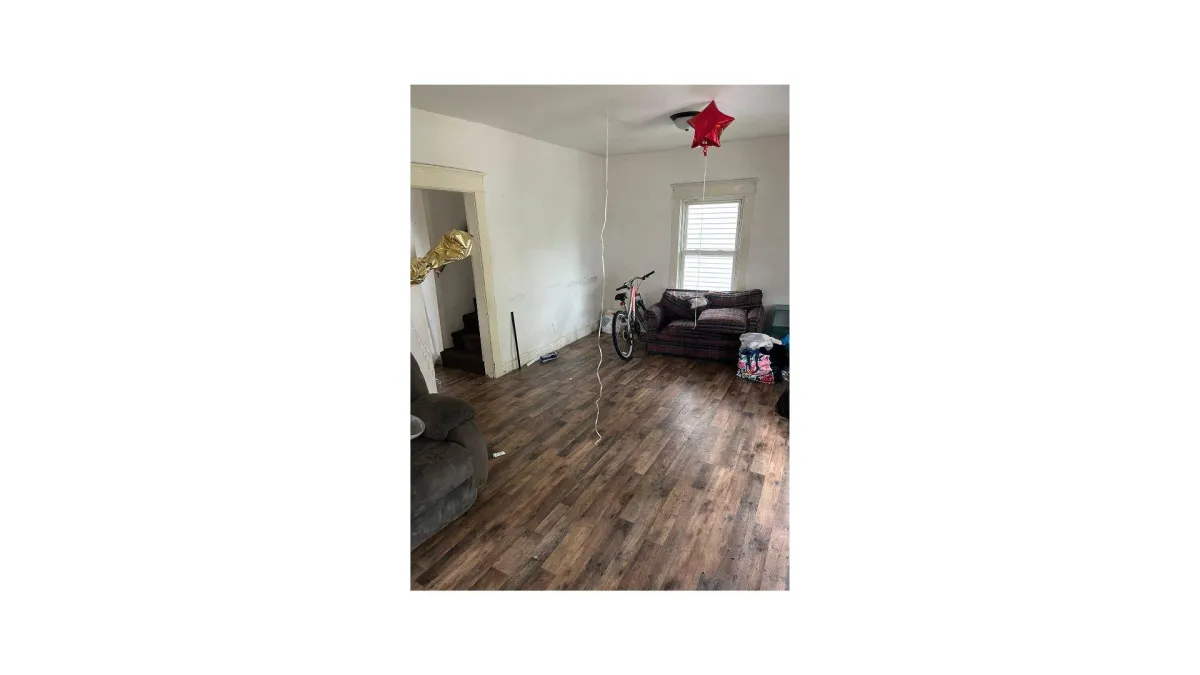

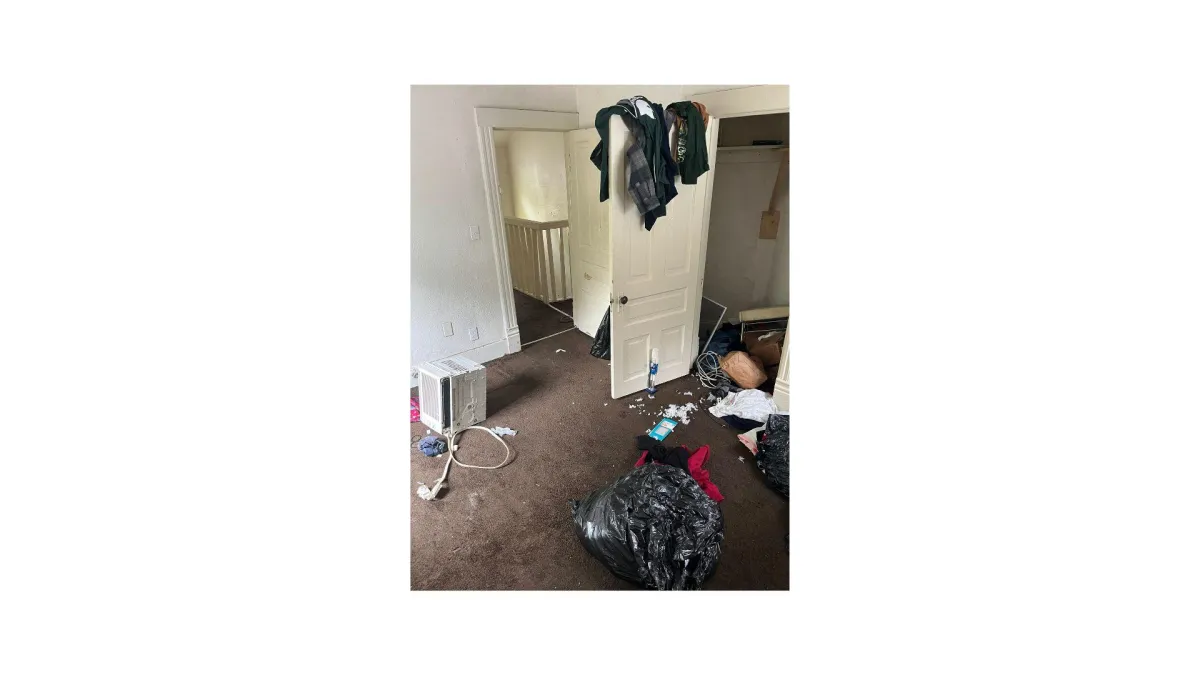

- Interior finishes (paint, flooring, lighting/trim): $16,000

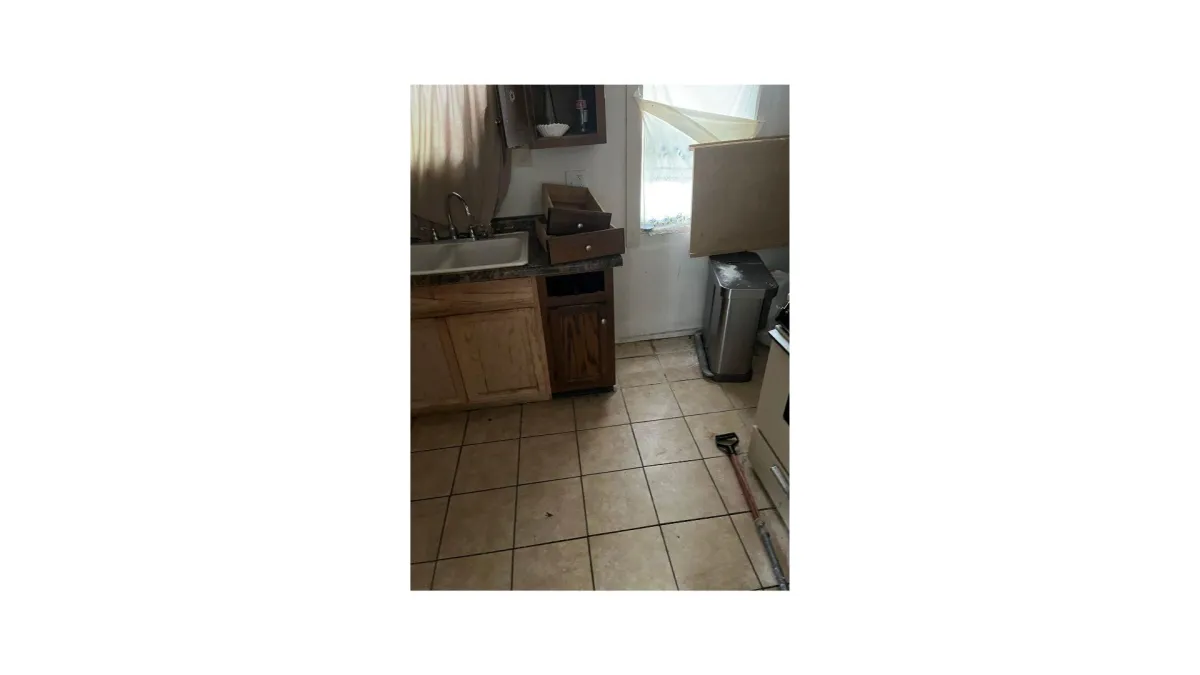

- Kitchen & bath refresh (surfaces/fixtures): $19,000

- Exterior & curb appeal (porch/entry, paint touch-ups): $8,000

- Systems & safety (HVAC/electrical/plumbing tune-ups, GFCI/smoke/CO): $10,000

ILLUSTRATIVE PAYOFFS (INTEREST-ONLY)

- Payoff in 4 months: 4 × $530.00 = $2,120.00 → Total to investor: $55,120.00

- Payoff in 6 months: 6 × $530.00 = $3,180.00 → Total to investor: $56,180.00

- Payoff in 9 months: 9 × $530.00 = $4,770.00 → Total to investor: $57,770.00

ARV SUPPORT — NEARBY CLOSED SALES (COMPARABLES)

- 420 S Holmes — 903 sf — $155,000 (2025-05-15) — $172/sf

- 221 Virginia — 1,056 sf — $170,000 (2025-06-10) — $161/sf

- 1328 Eureka — 864 sf — $142,000 (2024-10-02) — $164/sf

Summary: Comps cluster around $155,000 with an average ≈ $166/sf, supporting a retail ARV target near $160,000 post-renovation.

COLLATERAL & PROTECTIONS

- Promissory Note + Mortgage (first position where available; otherwise subordinate behind purchase capital).

- Lender named loss payee on hazard insurance; proof of coverage at closing.

- Title insurance; closing through licensed title/escrow.

- Contractor lien waivers; right to inspect work; weekly progress/photos; budget tracking.

EXIT & TIMELINE

- Strategy: Fix & flip to retail buyer after cosmetic and safety upgrades.

- Timeline: 6–8 weeks rehab → list immediately → target buyer closing 60–90 days from listing.

ADMIN / FUNDING

- Funding: Investor wires $53,000 to title at closing; interest accrues from funding date; first interest payment due 30 days post-funding.

Contact: David - 517-624-3630 | [email protected]

NOTES

- This “rehab-only” note excludes purchase and non-rehab holding/closing costs; if those are to be covered, terms can be adjusted.